Understanding the nuances of Maryland MLO bonds is crucial for those entering the mortgage lending industry in Maryland. Mortgage Loan Originators (MLOs) must navigate a complex landscape of regulations and requirements to secure their licenses and operate legally. This guide aims to provide a comprehensive overview of the Maryland MLO bond application process, focusing on the essential steps, requirements, and best practices that candidates need to follow to ensure compliance and avoid pitfalls.

Challenges in Securing Mortgage Originator Bonds

While the benefits of mortgage originator bonds are clear, securing these bonds can also present challenges, particularly for those with less-than-perfect credit histories. Applicants may face higher premiums or, in some cases, may be denied bond approval altogether. This can be particularly concerning for new entrants in the mortgage industry who may not have a robust financial history to showcase.

In Maryland, MLO bonds serve as a form of surety that protects consumers and ensures that licensed MLOs adhere to state laws and regulations. If you want to explore further, West Virginia Fishing Permit Surety is a helpful reference. These bonds are not merely a formality; they play a vital role in the integrity of the mortgage industry, assuring clients that lenders are operating ethically and responsibly. As you delve into this guide, you will learn about the various components of MLO bonds, the application process, costs involved, and how to successfully manage your bond obligations.

Additionally, MLOs must ensure that their bond remains active and renewed as required. Most MLO bonds are issued for a specific term, and it is the responsibility of the bondholder to renew the bond before its expiration. Typically, renewal involves paying the premium again and undergoing a brief review process by the surety company. Neglecting to renew your bond can leave you operating without legal protections, which can have dire consequences.

It’s also important to compare rates and terms offered by different surety providers. While cost is a factor, it should not be the sole determinant in your decision-making process. Assess the level of customer service and support provided by each company, as having a responsive and knowledgeable agent can be invaluable, especially when navigating compliance issues.

This table outlines key requirements and considerations for securing MLO bonds in New Mexico. For a practical overview, West Virginia Fishing Permit Surety is worth a look. Understanding these elements can significantly impact the success of the application process. By adhering to these guidelines, applicants can better navigate the complexities of MLO bonding and position themselves for success in the competitive mortgage industry.

Moreover, MLO bonds contribute to a more stable mortgage lending environment by holding originators accountable. The existence of this bond means that MLOs must operate within legal and ethical boundaries, providing consumers with an added layer of security. In essence, MLO bonds serve as a foundational element of trust in the mortgage lending system, ensuring that all parties adhere to the rules and regulations governing the industry.

Another common issue is underestimating the importance of credit history. Many applicants may not realize that their credit score can significantly impact their bond premiums and approval chances. Neglecting to address negative credit factors before applying can lead to unfavorable terms or outright rejection. Therefore, it's advisable to check credit reports and rectify any inaccuracies or discrepancies in advance.

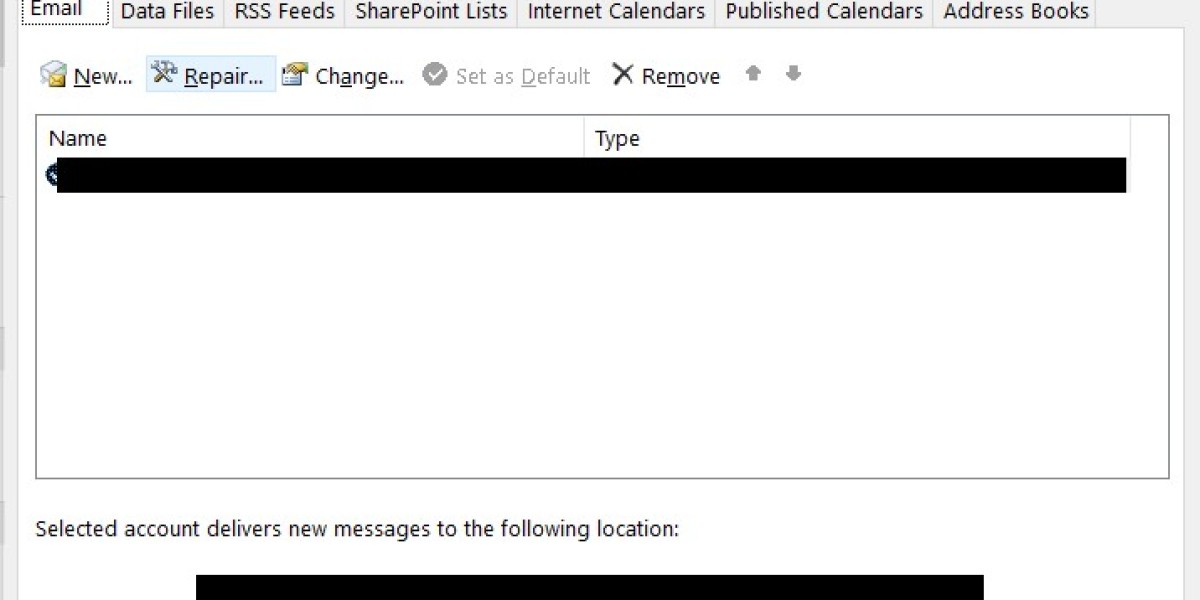

Bond Type

Amount Required

Typical Premium Range

New York MLO License Bond

$100,000

1% - 5%

General Contractor Bond

$10,000 - $100,000

1% - 3%

Performance Bond

$50,000 - $1,000,000

0.5% - 3%

Bid Bond

$10,000 - $100,000

1% - 3%

License Bond

$10,000 - $100,000

1% - 4%

Furthermore, being bonded enhances the credibility of your business. It demonstrates to potential clients that you are committed to ethical practices and are financially responsible. In a competitive market, having a bond can differentiate you from other originators who may not prioritize compliance. The bond essentially serves as a testament to your professionalism and reliability, which can significantly enhance your customer acquisition efforts.

Additionally, the 2025 compliance blueprint may introduce more stringent reporting requirements. Mortgage originators may be required to submit regular financial statements and proof of bond coverage to state regulators. This increased transparency is designed to prevent fraud and ensure that originators maintain a healthy financial standing. For businesses, this means being prepared to maintain detailed financial records and ensure timely reporting to avoid penalties.

Networking within industry associations can also help originators connect with reputable surety providers. Attending industry conferences, seminars, and workshops provides opportunities to meet with surety experts, learn about new offerings, and gain insights into market trends. These interactions can lead to partnerships that benefit both the originators and the surety providers.

antonybauer298

5 Blog Beiträge