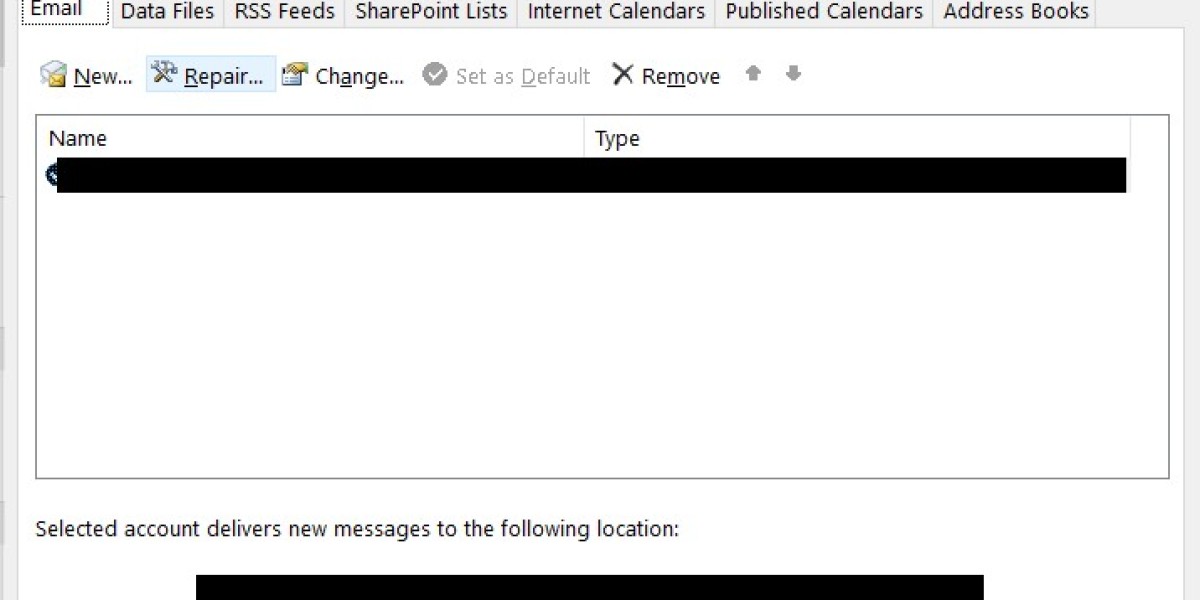

Once the educational requirements are satisfied, individuals can apply for their license through the NMLS. This application process includes submitting personal and financial information, undergoing a background check, and providing proof of the required bond. To secure the bond, applicants will need to work with a surety bond provider, who will evaluate their creditworthiness and set the bond premium accordingly.

Moreover, mortgage originators must also ensure that they maintain accurate records of all transactions and communications with clients. This documentation is critical not only for compliance purposes but also for protecting against potential claims against the bond. Keeping thorough records can help establish your credibility and provide evidence in case of disputes with clients.

2025 Filing Requirements: What MLOs Need to Know

As we approach 2025, MLOs must familiarize themselves with the specific filing requirements associated with Maryland MLO bonds. The Maryland Department of Labor oversees the licensing and bonding of mortgage loan originators, ensuring that all practitioners comply with state regulations. In 2025, MLOs will need to submit their bond filings along with their license renewal applications, which are typically due by December 31 of each year.

With the impending filing requirements, MLOs must be proactive in ensuring they meet all necessary obligations. This involves comprehensively understanding what these bonds entail, the application process, and the implications of non-compliance. As the landscape of mortgage lending continues to change, staying informed about bonding requirements can significantly impact operational efficiency and financial stability.

When weighing the pros and cons of mortgage originator bonds, it is essential to consider both the immediate costs and the long-term benefits. While the financial burden of obtaining a bond may seem daunting, the protection and credibility it offers can significantly outweigh these challenges. Mortgage originators must remain vigilant in adhering to compliance requirements to maximize the benefits of being bonded.

Market Demand for Quick Financing Solutions

The demand for quick financing solutions is a driving force behind the acceleration of MLO approvals in New Mexico. As the economy continues to recover and grow, businesses are increasingly seeking timely access to funds to capitalize on emerging opportunities. This shift in market dynamics places pressure on MLOs to deliver faster results without compromising on quality. Companies that can provide rapid financing solutions are more likely to gain a competitive edge, making it essential for MLOs to adapt to this changing landscape.

Conclusion

Understanding mortgage loan originator bonds in West Virginia is crucial for professionals seeking to thrive in the mortgage industry. For more details, City of New York, which adds useful context. These bonds not only serve as a legal requirement but also enhance credibility and trust with clients. By navigating the complexities of the NMLS requirements and staying compliant with state laws, loan originators can protect themselves and build a successful business. As the financial landscape continues to evolve, maintaining a strong grasp of bonding requirements will be a key component of operational success. By prioritizing compliance and ethical practices, mortgage loan originators can foster a trustworthy environment that benefits both their clients and their business in the long run.

Can I operate in multiple states with one bond?

No, typically you need to obtain a separate bond for each state in which you operate due to varying regulations and bond amounts. Understanding each state’s requirements is essential for compliance.

Once the risks have been identified, mortgage loan originators should develop clear policies and procedures that outline how compliance will be achieved. This includes defining roles and responsibilities for compliance tasks, establishing reporting mechanisms for compliance breaches, and outlining the steps for addressing potential violations. Furthermore, ensuring that these policies are communicated effectively to all staff members is crucial for fostering a culture of compliance throughout the organization.

As stakeholders become more familiar with these innovations, the expectation for speed and efficiency increases. Consequently, MLOs who invest in technology can expect to see a direct correlation between their operational capabilities and overall success. For business professionals in New Mexico, understanding these technological advancements is crucial for optimizing their financing strategies and improving their service offerings.

Compliance Requirements for Mortgage Loan Originators

Compliance with state and federal regulations is paramount for mortgage loan originators. In West Virginia, loan originators must adhere to a variety of laws and regulations that govern their operations. These include the West Virginia Residential Mortgage Lender, Broker, and Servicer Act, which sets forth licensing, conduct, and operational requirements to protect consumers and ensure a fair lending environment.

antonybauer298

5 Blog Beiträge