Best Practices for Filing Mortgage Originator Bonds

To streamline the filing process and enhance the chances of approval, mortgage originators should adhere to several best practices. First, maintaining accurate and up-to-date financial records is essential. This includes regular audits and assessments of the business's financial health. Such diligence not only aids in the bond application process but also provides a clear picture of the company's operational efficiency.

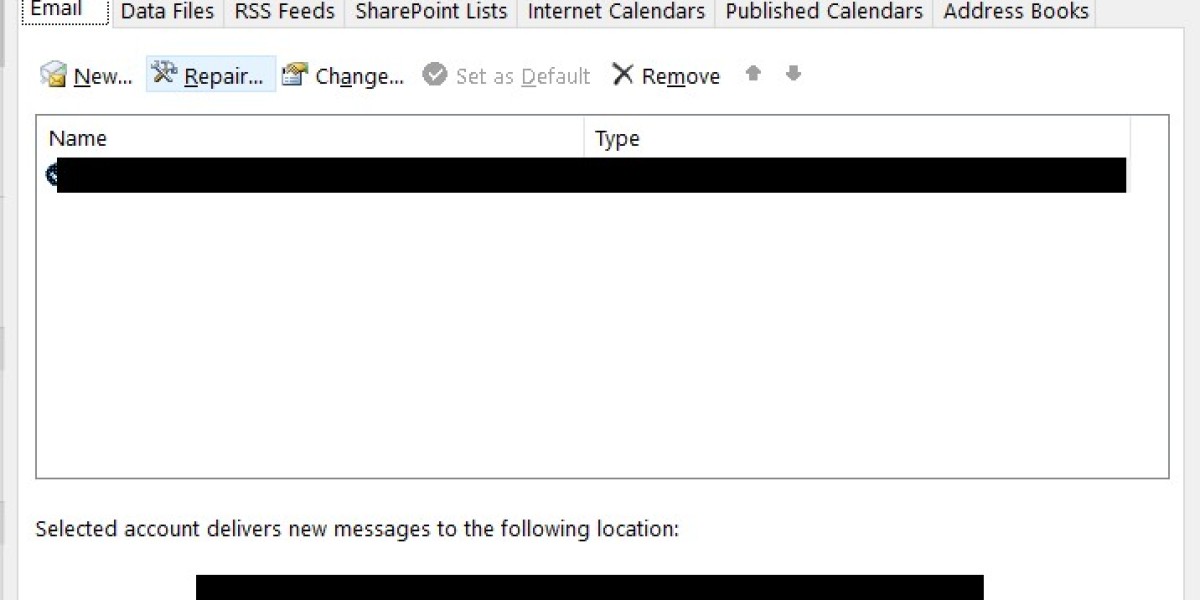

After the application is submitted, the surety underwriter will review the provided information, a process that can take anywhere from a few days to several weeks. Once approved, the bond will be issued, and the originator must ensure that it is filed with the appropriate regulatory agency. Failure to file the bond correctly can result in delays or complications in the licensing process, potentially hindering the ability to operate legally in the state.

Typically, MLOs can expect to pay between 1% and 15% of the total bond amount as a premium, with higher rates applied to those with lower credit scores or other risk factors. To ensure a competitive rate, it is advisable for applicants to shop around and obtain quotes from multiple surety bond providers. This not only allows for cost comparison but also provides insight into various underwriting criteria and practices.

Choosing a Reliable Bond Provider

Selecting the right bond provider is a pivotal step in securing your mortgage originator bond. Not all surety companies are created equal, and the choice of provider can significantly impact your business's risk management strategy. It is essential to conduct thorough research and consider factors such as the provider's reputation, financial stability, and customer service track record. A reliable bond provider will not only facilitate your bonding process but also offer ongoing support and guidance throughout your business operations.

When evaluating potential bond providers, look for those with experience in the mortgage industry. Providers that understand the specific challenges faced by mortgage originators can offer tailored solutions that align with your operational needs. Additionally, consider seeking referrals from industry peers or associations, as firsthand experiences can provide valuable insights into the quality and reliability of bond providers.

How do I renew my mortgage originator bond?

Renewing your mortgage originator bond generally involves submitting a renewal application to your bond provider along with any required documentation. It's important to keep track of renewal dates to maintain compliance with state regulations.

In weighing the pros and cons of obtaining mortgage originator bonds, it is evident that while there are costs and complexities involved, the benefits often outweigh the drawbacks. Strong consumer protection, enhanced credibility, and regulatory compliance are invaluable assets for mortgage originators. However, careful financial planning and understanding of the bonding process are essential in maximizing these benefits.

How much does a mortgage originator bond cost?

The cost of a mortgage originator bond typically ranges from 1% to 3% of the bond amount, which in New Mexico is usually set at $25,000. Factors affecting the cost include credit history and financial stability.

With the potential for significant financial implications, both for the originators and their clients, understanding the bonding process is crucial. This article will illuminate the steps necessary to obtain and maintain Connecticut Mortgage Originator Bonds, drawing attention to the implications of compliance failures and the benefits of being well-informed. We will explore everything from application processes to the financial guarantees provided by these bonds, ensuring that you are not only compliant but also strategically positioned for success.

Additionally, be aware of any changes in your personal or professional circumstances that could affect your bond. For instance, if you change your business structure or experience financial difficulties, these factors may necessitate adjustments to your bond coverage. Keeping your bond provider informed of any significant changes is essential for maintaining compliance.

Additionally, mortgage originators must provide evidence of their surety bond along with their application. This bond serves as a prerequisite for obtaining a license and must remain in effect for the duration of the license. Without this bond, the application will not be considered complete, underscoring the bond's essential role in the licensing process.

In the competitive landscape of mortgage origination, understanding the nuances of compliance and bonding can be the difference between success and failure. New Mexico Mortgage Originator Bonds are essential for professionals looking to secure their licenses and solidify their standing in the industry. These bonds not only fulfill regulatory requirements but also signify trustworthiness and financial reliability to clients and partners alike.

In the event you beloved this post as well as you would want to obtain guidance relating to Maryland Construction Surety i implore you to stop by our webpage.

efrenwickman23

5 ブログ 投稿