Moreover, the financial implications of license and permit bonds are significant. The cost of not securing the appropriate bonds can lead to fines, work stoppages, and even legal issues that can jeopardize the future of a business. This article aims to demystify the landscape of Lake County IN license and permit bonds, providing critical insights, practical applications, and actionable information that will help business professionals navigate this complex terrain effectively.

This table outlines the various types of Tennessee State Bonds, their typical requirements, and average premiums. To learn more, Mississippi - Pawnshop Bond covers this in more depth. Understanding these parameters can help businesses prepare for the bonding process and budget accordingly for their bonding needs.

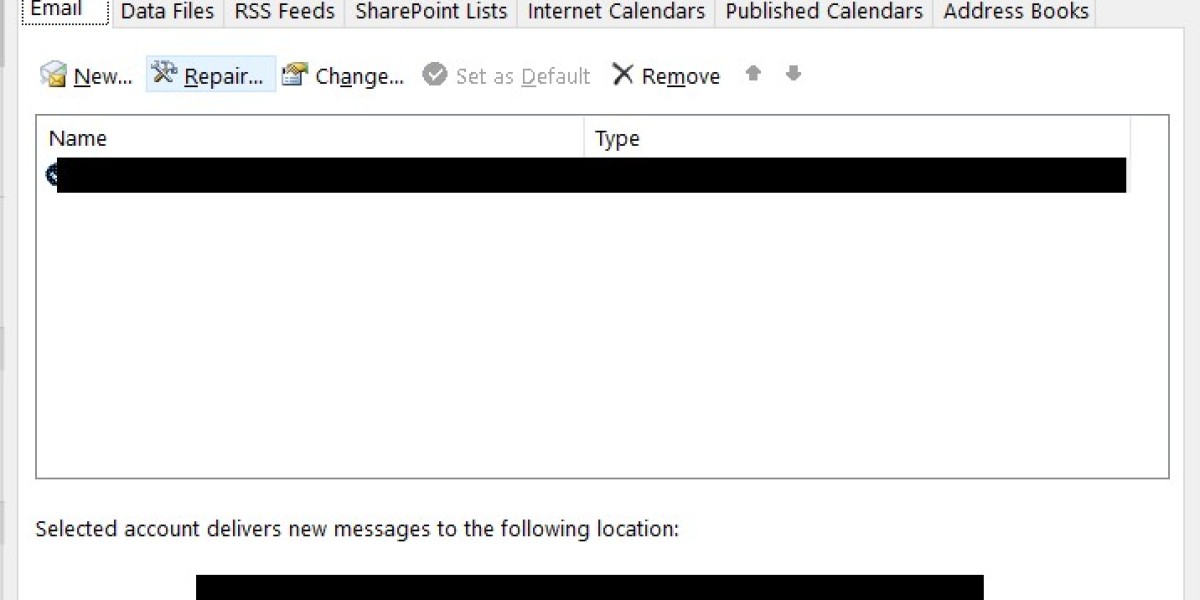

Bond Type

Average Approval Time (Days)

Common Requirements

Performance Bond

5-10

Credit Score, Business History

License Bond

3-7

Proof of License, Insurance

Payment Bond

7-14

Contractor's Financials

Bid Bond

2-5

Bid Proposal, Business Information

Subdivision Bond

10-15

Project Plans, Financial Statements

What happens if I fail to secure a pawnshop bond?

Failure to secure a pawnshop bond can result in an inability to obtain a pawnshop license, leading to potential legal penalties and operational disruptions. It is crucial to comply with bonding requirements to maintain legitimacy in the industry.

Benefits of Securing Tennessee State Bonds

Securing Tennessee State Bonds offers numerous benefits for businesses, particularly in terms of compliance and credibility. For a practical overview, Mississippi - Pawnshop Bond is worth a look. One of the primary advantages is that bonds serve as a guarantee that contractual obligations will be met. This assurance can significantly enhance a business's reputation, as clients are more likely to trust contractors who hold the necessary bonds. In industries where trust and reliability are paramount, having bonds can set a business apart from competitors.

Types of Bonds for Pawnshops

There are primarily two types of bonds that pawnshops in Mississippi may need to secure: the license bond and the performance bond. For a practical overview, Mississippi - Pawnshop Bond is worth a look. Each type serves a different purpose and addresses unique aspects of compliance within the pawn industry. The license bond is generally required to obtain a pawnshop license, ensuring that the operator adheres to all local regulations. On the other hand, a performance bond guarantees that the pawnshop will fulfill its contractual obligations to customers and the state.

Moreover, the ability to lower deposit amounts can lead to a more significant impact on long-term financial planning for small businesses. To learn more, Mississippi - Pawnshop Bond covers this in more depth. The reduction in initial costs allows for better allocation of resources, which can be redirected towards growth initiatives or operational improvements. As we delve deeper into the strategies that Georgia utility customers are employing to minimize their deposit requirements, we will unveil actionable insights and examples that can be beneficial for business professionals across the state.

What happens if I do not secure the required bonds?

Failing to secure the required bonds can lead to fines, work stoppages, and potential loss of the right to operate. Additionally, it can damage your business's reputation, causing lost revenue and missed opportunities.

Understanding the importance of Mississippi pawnshop bonds goes beyond mere legal compliance; it is an essential part of your business model that can significantly impact your bottom line. By securing these bonds, businesses can protect themselves against potential losses due to fraud or mismanagement, while also ensuring that they meet customer expectations regarding security and reliability. As we delve into this topic, we will cover critical areas such as types of bonds, the application process, and ongoing compliance requirements, ensuring that you are well-equipped to navigate the complexities of the pawn industry.

Understanding Pawnshop Bonds in Mississippi

Pawnshop bonds serve as a form of financial guarantee that protects consumers from potential misconduct by pawnshop operators. In Mississippi, these bonds are mandated by state law and are required for anyone wishing to operate a pawnshop. The bond amount typically varies based on the size of the business and the specific regulations set forth by local authorities. By securing a bond, the pawnshop pledges to adhere to all applicable laws and regulations, thereby safeguarding the interests of both the consumer and the community.

How do I apply for a pawnshop bond in Mississippi?

To apply for a pawnshop bond, you must gather necessary documentation, complete the bond application, and submit it to a bonding company. The company will review your application, conduct a credit check, and determine the bond amount and premium.

randolphpegues

5 بلاگ پوسٹس