Finally, consider leveraging technology to your advantage. Many surety companies now offer online applications and resources that can simplify the process. Utilizing these tools can save time and reduce the likelihood of errors, ultimately speeding up your bond approval.

How can I ensure I get the best bond rates?

Maintaining a strong credit score and good financial practices can help secure lower bond premiums. Additionally, shopping around for quotes from different bonding providers can lead to more favorable terms.

In addition to fostering trust and credibility, compliance can also offer retailers a competitive edge. In an increasingly crowded marketplace, businesses that prioritize legal and ethical practices stand out. Retailers that can demonstrate their commitment to compliance through financial responsibility bonds are likely to gain favor with consumers who are more conscientious about where they shop. As a result, investing in compliance can yield significant returns through increased sales and enhanced business relationships.

Moreover, consider conducting regular internal audits to assess compliance with storage requirements. These audits can help identify areas for improvement and ensure that your business adheres to all regulations. Documenting these audits also provides evidence of your commitment to compliance, which can be beneficial if you face any regulatory scrutiny.

Preparing for the Bond Application Process

The bond application process can be daunting for new manufacturers. To start, manufacturers need to gather all relevant documentation that demonstrates their financial stability and business legitimacy. This includes financial statements, business licenses, and proof of insurance. These documents are essential as they help underwriters assess the risk associated with issuing the bond. A new manufacturer must present a comprehensive picture of their business to facilitate a smooth application process.

Requirement

Description

Importance

Business License

Proof of your business's legality in Illinois.

Essential for ensuring compliance with state regulations.

Proof of Insurance

Documentation showing that you have the required liability insurance.

Protects against potential claims arising from your operations.

Financial Statements

Recent financial records demonstrating your business's stability.

Helps the surety assess your ability to meet bond requirements.

Credit Report

A report detailing your business's credit history.

Influences the bond premium and approval likelihood.

Application Form

The official form to initiate the bonding process.

Required to begin the evaluation process by the surety.

Fees

Any applicable fees associated with the bond application.

Necessary for covering administrative costs.

How can new manufacturers ensure compliance with bond requirements?

New manufacturers can ensure compliance by regularly reviewing their business practices and staying updated on any changes in regulations. Implementing a compliance management system and maintaining communication with their surety provider can also help in meeting bond obligations.

Moreover, the bond serves as a layer of protection for consumers and the state. If a tire storage facility fails to comply with regulations, the bond can be used to cover the costs associated with cleanup or remediation efforts. This not only protects the environment but also holds businesses accountable for their actions. As such, understanding the importance of tire storage bonds is crucial for anyone looking to enter or operate within this sector.

Navigating the world of construction and contracting in Illinois can be complex, especially when it comes to understanding compliance requirements such as the Illinois Union Wage Bonds. These bonds play a crucial role in ensuring that contractors adhere to local wage laws and regulations while also protecting the rights of workers. For many small to mid-sized businesses, the intricacies of these bonds can seem overwhelming, yet grasping their significance is essential for maintaining compliance and securing lucrative contracts.

As a contractor, understanding the nuances of Illinois Union Wage Bonds is not just about compliance; it is about fostering a reputation for reliability and trustworthiness in the industry. Failing to meet bond requirements can lead to significant delays in project timelines, financial penalties, or even disqualification from bidding on future projects. This article aims to demystify the concept of Union Wage Bonds, outlining what contractors must know to navigate this critical aspect of their business successfully.

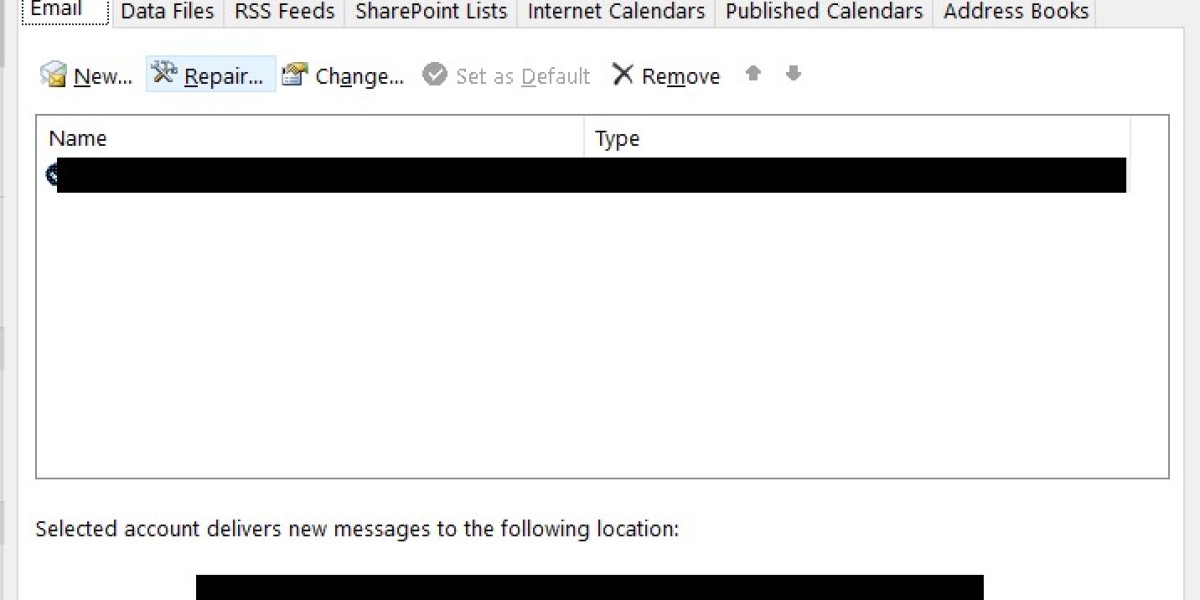

This table outlines the key requirements for obtaining an Illinois CDL testing bond. Each element plays a significant role in ensuring a smooth bonding process and maintaining compliance with state regulations. By understanding and preparing these requirements in advance, you can expedite your approval and minimize potential setbacks.

If you beloved this informative article as well as you want to obtain more information concerning IL - Individual Highway Permit Bond generously pay a visit to the webpage.

valencianorieg

5 Blog posts