What happens if I fail to pay the utility bill?

If a business fails to pay its utility bill, the utility provider may file a claim against the bond to recover the owed amount. This could result in additional costs for the business and potential damage to its credit rating.

Application Process for Reclamation Bonds

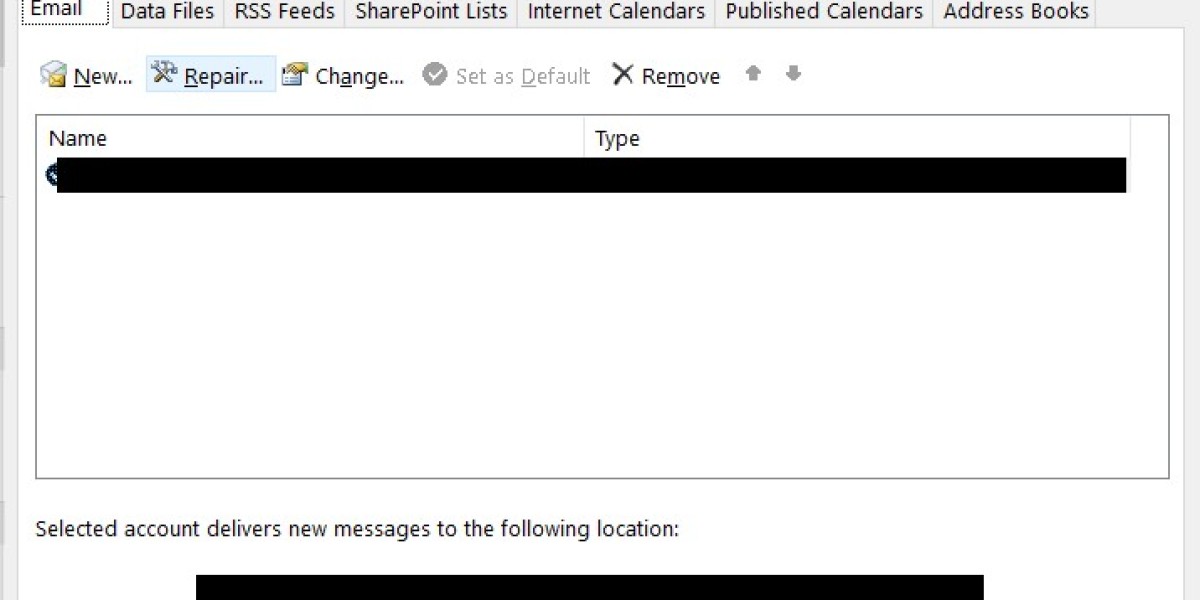

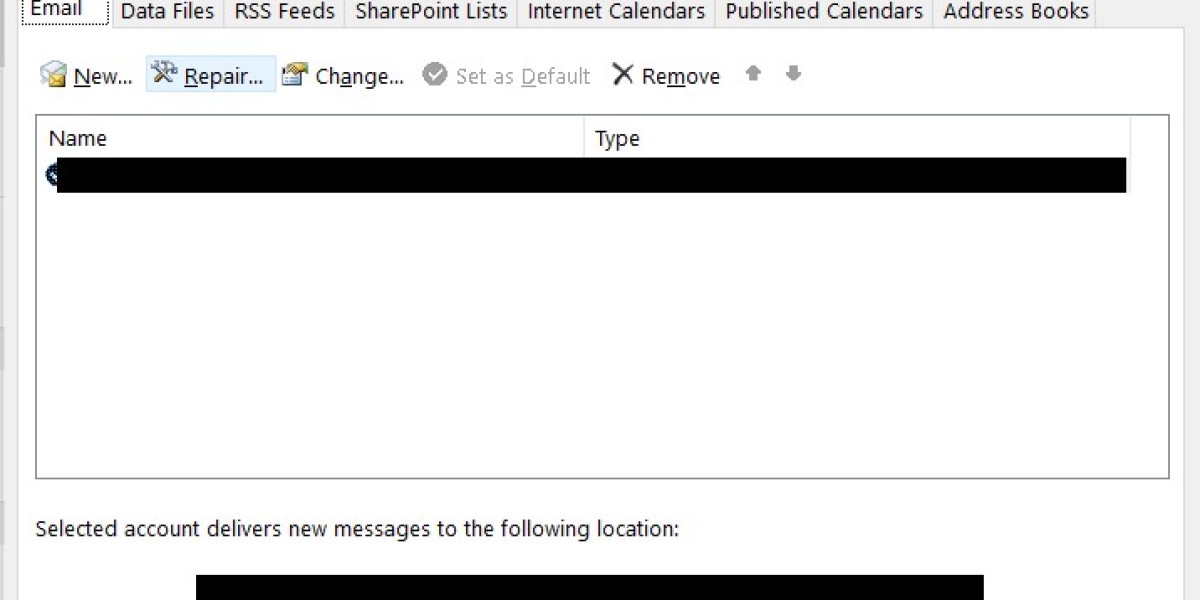

The application process for securing Oklahoma reclamation bonds is a crucial step for operators looking to comply with state regulations. Generally, the process begins with submitting an application to a surety company, where the operator's financial stability, experience, and project details will be evaluated. This assessment helps the surety determine the operator's eligibility for the bond and the associated premium costs. Operators should be prepared to present various documents, including financial statements, project plans, and evidence of compliance with local regulations.

What are the financial implications of non-compliance?

Non-compliance can result in hefty fines, operational shutdowns, and significant costs associated with environmental remediation. Businesses must prioritize compliance to avoid these financial repercussions.

The landscape of the construction and utility industries is constantly evolving, and navigating the complexities of regulatory requirements can be daunting, especially when it comes to Oklahoma reclamation bonds. These bonds play a critical role in ensuring that operators meet their obligations for land reclamation, environmental protection, and compliance with state regulations. For small business owners and contractors operating in Oklahoma, understanding the intricacies of these bonds is essential to maintaining compliance and securing the necessary permits for operations.

Once the documentation is in order, the next step is to identify a reputable surety bond provider. This choice is crucial, as different providers may offer varying terms, rates, and conditions. Business owners should take the time to research potential providers and seek out recommendations from peers in their industry. Engaging with a surety bond agent can streamline this process, as they can provide insights into which companies are best suited to meet specific needs.

Frequently Asked Questions

What is the purpose of a right-of-way bond?

A right-of-way bond serves as a financial guarantee that a contractor will comply with local regulations while working on public land. It protects the state and public by ensuring that any damages or failures in project execution can be addressed financially.

Costs Associated with Reclamation Bonds

The costs of securing reclamation bonds can vary widely based on several factors, including the size of the project, the operator's creditworthiness, and the specific bond type. Typically, the bond premium is calculated as a percentage of the total bond amount, ranging from 1% to 15% depending on the perceived risk associated with the operator. Operators should conduct thorough research to understand the potential costs and budget accordingly, as these expenses can impact overall project profitability.

Conclusion

Navigating the world of Georgia Utility Deposit Bonds can be a daunting task for many small business owners, but with the right understanding and strategy, it can lead to significant operational advantages. By employing a structured customer filing strategy, businesses can effectively secure the bonds necessary to access essential utility services without the burden of large upfront deposits. Understanding the requirements, avoiding common pitfalls, and recognizing the benefits of these bonds are crucial steps in this process. As businesses continue to seek ways to streamline operations and improve cash flow, Georgia Utility Deposit Bonds represent a valuable tool in achieving these goals.

Another significant challenge is financial scrutiny. For a practical overview, Kirtland Contractor Bond is worth a look. As bond requirements become more stringent, businesses with limited financial histories may find it difficult to demonstrate their ability to meet bond obligations. This is particularly true for small business owners and sole proprietors who may not have the same financial resources as larger corporations. To mitigate this risk, it is advisable to maintain transparent financial records and be prepared to provide additional information if requested by surety companies.

Conclusion

In conclusion, avoiding ROW bond delays is essential for Fishers contractors striving to maintain efficiency and profitability. By understanding the importance of ROW bonds, leveraging technology, building strong relationships with surety providers, ensuring compliance with local regulations, and utilizing structured processes, contractors can mitigate the risks associated with bond delays. Each of these strategies contributes to a more streamlined and effective bonding process, allowing contractors to focus on what they do best—delivering high-quality projects on time and within budget. As the construction landscape continues to evolve, staying informed and adaptable will position Fishers contractors for success in a competitive market.

felishakdo3556

5 博客 帖子